Charge Sheet Implicating two KRA officials on pocession of counterfeit Products oxygene.co.ke

Charge Sheet Implicating two KRA officials on pocession of counterfeit Products oxygene.co.ke

Charge Sheet Implicating two KRA officials on pocession of counterfeit Products. IMAGE Courtesy oxygene.co.ke

Directorate of Criminal Investigations (DCI) and Kenya Revenue Authority (KRA) wish to restate their joint commitment to deepen collaboration in combating tax evasion and corruption involving collusion between taxpayers and KRA staff. The collaboration focuses on varied aspects including the management of Customs clearance operations and the tackling of illicit trade and both importation and local manufacturer level.

In this regard, the DCI and KRA wish to announce the arraignment in court of three Kenya Ports Authority (KPA) officials and one KRA official on charges of concealment and improper declaration of goods imported through the Port of Mombasa, contrary to section 202(a) of the East African Community Act 2004..

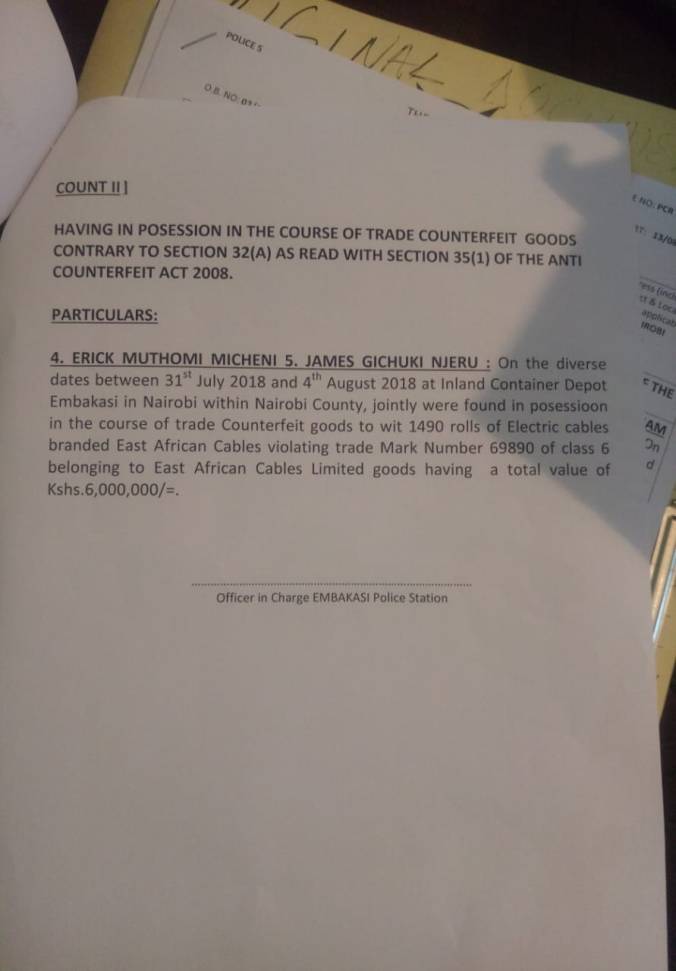

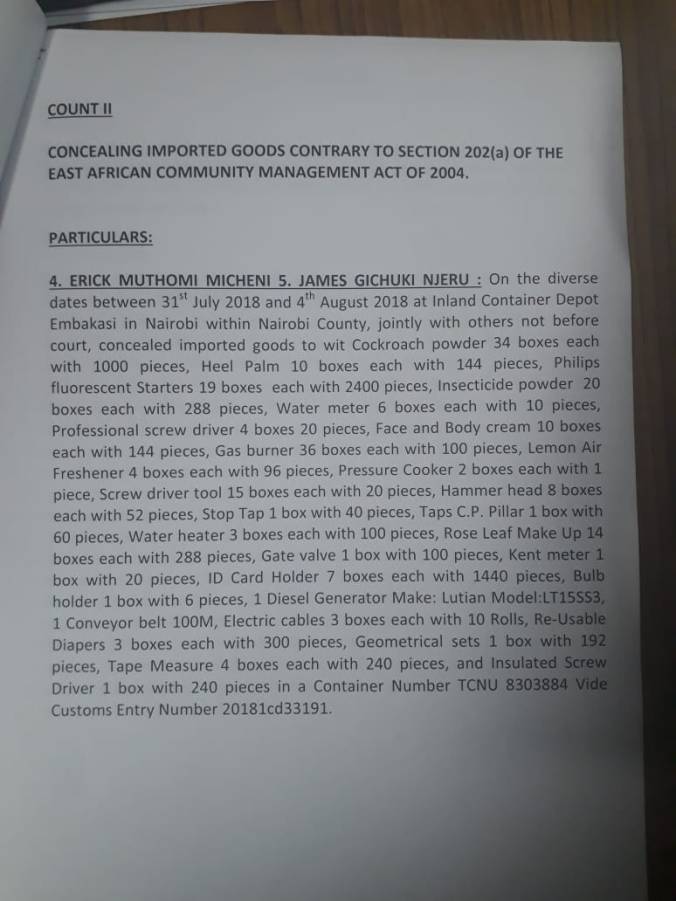

The individuals concerned are KRA’s Erick Micheni, while on KPA’s part those arrested include Tom Oyugi, Enock Omondi and William Langat all of whom are charged jointly with other persons not before court with concealing imported goods worth over Ksh6 million. According to the charge sheet, the accused on diverse dates between 31st July and 4th August this year concealed goods at a KPA shed at the Embakasi Inland Deport in Nairobi, with the intention to subsequently remove them without following prescribed processes.

Muchemi who is an ICT officer at KRA, is charged with a second count of concealing an assortment of imported goods on diverse dates over the same period. He is also additionally charged on a third count with being in possession of counterfeit goods contrary to section 32 (A) as read with section 35 (1) of the Anti-Counterfeit Act of 2008.

More interventions geared towards combating tax evasion and corruption in tax collection are in progress